Articles

from Our Office

Featured:

Decoding the IDGT Debate: IRS Revenue Ruling 2023-2 and Its Impact on Estate Planning

Discover the implications of IRS Revenue Ruling 2023-2 on Intentionally Defective Grantor Trusts (IDGTs). The ruling clarifies that gifted assets to an IDGT are taxable to the grantor for income tax but do not receive a step-up in basis upon the grantor’s death. Learn how this affects estate planning strategies and asset protection for beneficiaries.

Peace of Mind for Parents: The Importance of College Student Estate Planning

Amidst the preparations of sending your child to college, estate planning might not be top of mind. However, even young adults can benefit from basic estate planning, including documents like Durable Power of Attorney, Living Will, and HIPAA Authorization. Ensuring their wishes are respected and interests protected, this process fosters independence and prepares them for the responsibilities of adulthood.

The Leaky Will

Learn about the pitfalls of naming beneficiaries on employee benefits and accounts in estate planning. Discover the benefits of a joint revocable living trust, offering control, flexibility, and protection for your family’s future. Avoid probate, simplify administration, and ensure your assets align with your overall estate plan, bringing peace of mind. A joint revocable living trust to ensure control, protection, and peace of mind for your family’s future.

General Knowledge:

Estate Planning 102: Expanding Your Knowledge on Estate Preservation

Discover the essentials of estate planning in Washington state. This informative FAQ simplifies trusts, amendments, restatements, and more. Learn about common trusts, caring for children’s future, and handling retirement accounts as beneficiaries. Get insights into trust duration and the distinctions between guardianship and conservatorship. Ensure your assets are safeguarded for the future.

The ABCs of Estate Planning and Administration: A Simple Dictionary

Navigate the complexities of estate planning with this informative article. Explore crucial terms like attorney-in-fact, beneficiaries, and probate. Understand the significance of wills, trusts, and powers of attorney in safeguarding your assets and healthcare decisions. Plan for the future and protect your loved ones’ interests. Expert advice waits for you to make informed choices.

Estate Planning 101: Common Questions Answered

This article provides essential insights into estate planning, addressing common questions for Washington state residents. Understand the distinctions between wills and trusts, the roles of fiduciaries, and the benefits of avoiding probate. Learn how to create a pet trust and ensure your pet’s well-being. Consult experienced estate planning attorneys for personalized guidance.

More From Our Office:

When To Gift: Understanding the Subtleties of Strategic Timing in Estate Planning

When To Gift: Understanding the Subtleties of Strategic Timing in Estate PlanningThere isn't a 'one-size-fits-all' answer to this question, as it depends on a variety of factors, including your financial stability, the recipient's needs, and tax considerations. However, in general, it is wise to...

Understanding Taxation on Retirement Accounts: A Journey Through the Secure Act

Understanding Taxation on Retirement Accounts: A Journey Through the Secure ActWe all dream of a peaceful retirement, a time where our financial worries are at a minimum, and we can enjoy the fruits of our lifelong labors. But, like an intricate puzzle, the path to that dream often involves...

Exploring the Tax Trails of Irrevocable and Grantor Trusts

Exploring the Tax Trails of Irrevocable and Grantor TrustsThe estate planning world is a complex web of laws, strategies, and tools that strive to preserve wealth and achieve a seamless transition of assets. A trust, one of these tools, stands as a quiet sentinel, guarding the interests of its...

Navigating the Waters of Washington State Capital Gains Excise Tax in Estate Planning

Navigating the Waters of Washington State Capital Gains Excise Tax in Estate PlanningThe introduction of the Washington State Capital Gains Excise Tax has added a new layer to the complex tapestry of estate planning. This tax, which targets high-profit capital gains, has significant implications...

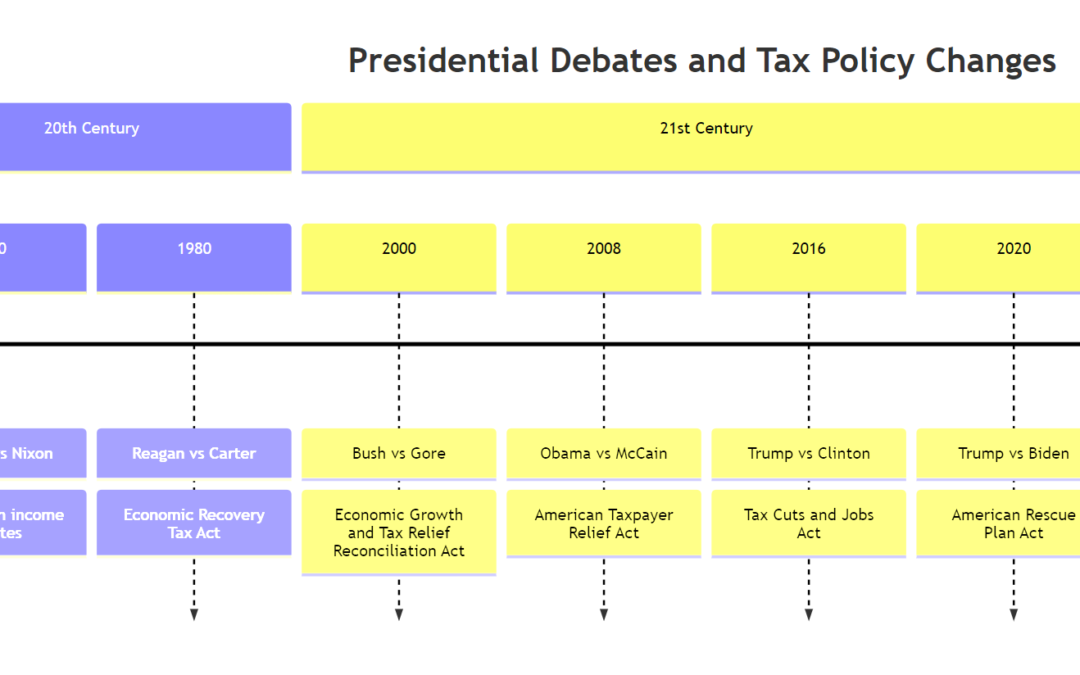

Presidental Debates: A Forecast for Estate Tax Policy Changes

Presidental Debates: A Forecast for Estate Tax Policy ChangesAs the political landscape shifts with each presidential election, so too does the tax policy. For those involved in estate planning, keeping an eye on these changes is crucial. Presidential debates often serve as the first glimpse into...

How a Community Property Trust Could Save You Money in Taxes

How a Community Property Trust Could Save You Money in Taxes .When it comes to your family’s legacy, every dollar you can save from taxation counts. One way to keep your accounts and property out of the hands of the Internal Revenue Service (IRS) is to form a community property trust. How Does a...

Phone

(206) 547-1412

Click to Email

Seattle Office & Mailing Address:

1833 N 105th St, Suite 301

Seattle, WA 98133

Redmond Office:

Thinkspace Redmond

8201 164th Ave NE, Ste 200

Redmond, WA 98052